[ad_1]

Journey patrons: strap yourselves in. Common ticket costs for company air journey are abruptly capturing skywards.

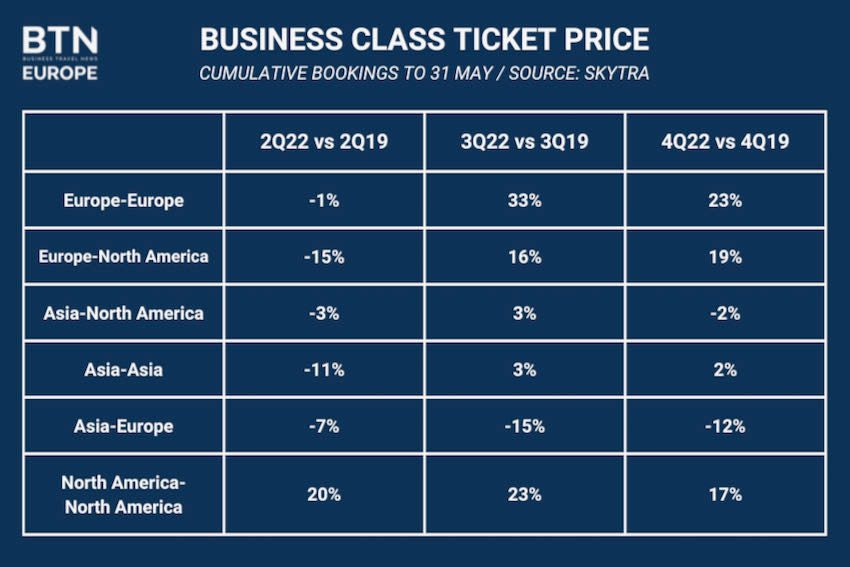

Intra-European enterprise class fares booked up to now for July-September 2022 are 33 per cent increased than the equal interval in 2019, in accordance with air fare benchmark administrator Skytra, a subsidiary of Airbus. That’s a major pivot from April-June 2022, when fares had been one per cent decrease than the identical quarter three years in the past.

It’s a comparable story for transatlantic enterprise class. Fares versus 2019 had been down 15 per cent in Q2 however have rocketed to 16 per cent increased for Q3. Europe-Asia stays depressed, nonetheless, largely due to China’s slowness in reopening. Fares had been seven per cent decrease versus in Q2 and are at the moment 15 per cent decrease in Q3.

Aurélie Duprez, founding accomplice of Areka Consulting, confirms company patrons can anticipate a tough experience. “We’re telling our purchasers they’ll anticipate their common ticket value to go up 20-30 per cent this yr,” she says.

A large number of things are aligning to pressure up the typical value paid. The obvious purpose – although removed from the one one – is that airways are growing base fares and surcharges, particularly within the type of surcharges for gasoline and different prices.

One monetary establishment journey supervisor, requesting anonymity, says he’s seeing surcharge will increase of “a few hundred euros” in some instances and that “many occasions airways don’t even inform company prospects they’re doing this.”

BTN Europe has written beforehand concerning the complete lack of transparency of airline surcharges. Because of this, whereas gasoline hikes are undoubtedly hurting many airways, with the Worldwide Air Transport Affiliation reporting oil prices up 40 per cent for its members, it’s not possible to guage when will increase are mandatory and when they’re opportunistic.

“Gasoline costs are extremely excessive however some airways are hedged with their gasoline shopping for, so they’re making good margins proper now as a result of they’ve locked in a low value,” says Skytra co-founder and chief gross sales and advertising and marketing officer Elise Weber. “On condition that demand is so excessive, they’ll cost extra.”

Pushing up value by growing surcharges reasonably than base fares is very damaging for company purchasers as a result of airways don’t apply negotiated reductions to the proportion introduced as a surcharge. “Shoppers are saying it’s unfair,” says Duprez.

Along with fare will increase, common ticket value is being pushed increased by corporations resuming long-haul journey after the pandemic, in accordance with each Duprez and CWT senior director for international provider administration Varinder Atwal. Because of this, common journeys are longer and subsequently inherently dearer.

We are able to anticipate 20 per cent fare rises on some routes as a result of airways have taken the chance to reshape their networks

One other contributory issue, says the nameless journey supervisor, is that his travellers haven’t but stop the behavior they shaped in the course of the pandemic of reserving a lot nearer to departure – sometimes as much as seven days forward in contrast with three weeks in 2019. ”When you e-book London-New York solely every week upfront, it’s going to be a way more costly ticket,” he says.

This explicit journey supervisor has additionally discovered his shopping for energy diminished. With airline capability nonetheless beneath pre-pandemic ranges however demand booming within the leisure market and a few company sectors, these corporations which haven’t returned to something like 2019 volumes are discovering themselves much less engaging prospects once they attain the negotiating desk.

“Our bookings are down 75-80 per cent in contrast with pre-pandemic,” says the journey supervisor. “We’ve seen in some negotiations that airways are decreasing their reductions. They’re making use of ranges of low cost they beforehand awarded to small and medium enterprises.” In such instances, he added, there’s prone to be solely a normal 5 per cent low cost, particularly as airways have fewer gross sales workers than pre-pandemic to handle company accounts like his.

His firm just isn’t the one one. “It’s true that in some instances, even with very massive purchasers, reductions are being downgraded,” says Duprez. “Shoppers predict fare will increase and they’re anticipating laborious negotiations this yr.” In some instances, she provides, airways are as an alternative “providing another advantages as compensation, resembling precedence boarding or lounge entry.”

Provide and demand components are additionally combining in one other uncommon strategy to thwart financial savings. “We are able to anticipate 20 per cent fare rises on some routes as a result of airways have taken the chance to reshape their networks. They’ve stopped plenty of routes that aren’t worthwhile, so there are going to be routes the place there is only one direct possibility and patrons haven’t any negotiation energy,” says Duprez.

“On the similar time, travellers are usually not as keen to take connecting flights as they had been pre-Covid. They need extra consolation. I see plenty of organisations altering their coverage in that respect, with much less pushing of travellers to fly not directly.”

Richard Johnson, senior director for journey administration firm CWT’s Options Group consulting enterprise agrees, and throws Planet as a consideration into the combo alongside Individuals and Revenue. Performing sustainably can push up the typical ticket value, Johnson believes, whether or not by decrease journey volumes decreasing shopping for energy, or by favouring direct flights, which price extra financially however much less when it comes to carbon. “With that realisation comes barely much less price range sensitivity,” he says. “The acknowledgement of paying a bit extra to realize these ends is beginning to embed.”

IATA is assuming international gross home product will develop 3.4 per cent this yr and says complete airline bills will rise 44 per cent versus 2021 owing to “bigger operations and price inflation”. All of it factors to even increased ticket costs forward. However, asks Atwal, is setting a tricky pricing atmosphere for company prospects “short-sighted whenever you don’t know in the long run what’s on the market?”

The journey supervisor thinks the reply to that query might be sure, and that airways might but discover themselves grateful for reliably common company enterprise. “As soon as preliminary demand is happy, you have got inflationary pressures ticking away, and the very first thing individuals will in the reduction of on might be holidays,” the journey supervisor says. “You have got price pressures on corporations in addition to households. What we now have now could be a vendor’s market however I’m unsure this may proceed for a very long time.”

[ad_2]

Source link

Recent Comments