[ad_1]

The Chase Sapphire Reserve® Card (review) is without doubt one of the hottest premium journey rewards bank cards. There are numerous issues to like concerning the card, like the great welcome bonus, triple points on dining and travel, a Priority Pass membership, Visa Infinite perks, rental automotive and journey protection, and rather more.

On this publish I needed to concentrate on the Chase Sapphire Reserve’s $300 annual journey credit score, which is the only best perk of the cardboard, because it earns you again greater than half of your $550 annual payment yearly. The best way I view it, which means that the cardboard ought to actually solely price you $250 per 12 months to carry onto.

Understandably this perk causes loads of confusion, since several cards offer travel credits, and a few of them have loads of strings connected. Fortuitously, the one on this card is sort of simple. So let’s go over all the particulars of the perk.

What’s the Chase Sapphire Reserve $300 journey credit score?

Each cardmember 12 months, the Chase Sapphire Reserve affords a $300 journey credit score. This credit score is utilized to purchases robotically — there’s no must register — and you should use it over as many purchases as wanted till the credit score is totally used up (so that may be a single $300 buy, 10 purchases of $30 every, and so on.). This comes within the type of a press release credit score that posts shortly after you make your buy.

What qualifies as journey for the $300 journey credit score?

What purchases will robotically be credited as journey? The Chase Sapphire Reserve defines journey as together with the next purchases:

Retailers within the journey class embrace airways, lodges, motels, timeshares, automotive rental companies, cruise traces, journey companies, low cost journey websites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking heaps and garages.

Word that this is identical definition that Chase makes use of for the classes that earn 3x factors. As you’ll be able to see, it’s not simply conventional journey purchases that get reimbursed, but additionally issues like Ubers, parking, trains, buses, and extra. You possibly can simply use the $300 credit score in your day-to-day life.

When do you get the $300 Chase Sapphire Reserve journey credit score?

As quickly as you activate the Chase Sapphire Reserve you’ll be able to instantly begin utilizing the journey credit score. There’s no ready interval required.

In subsequent years, your $300 journey credit score is legitimate beginning in your anniversary account date, which might be 12 month-to-month billing cycles after you opened the cardboard.

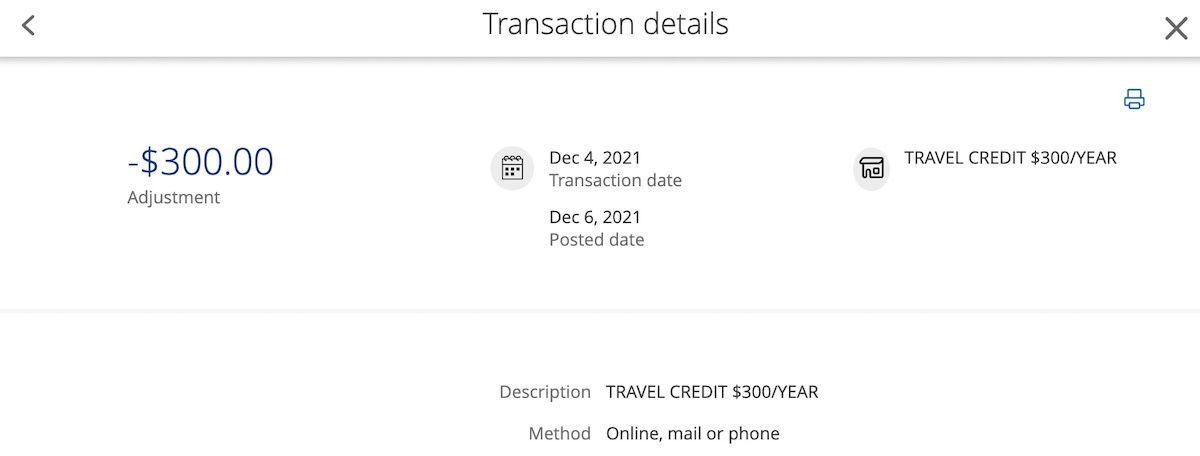

How shortly does the Sapphire Reserve $300 journey credit score publish?

The credit score ought to publish nearly immediately after a purchase order posts to your assertion. For instance, my cardmember anniversary is in December, and in early December 2021 I had a $300+ journey buy that was reimbursed nearly immediately. With this profit, you don’t have to attend for a number of weeks for the credit score to publish, or something.

Does the $300 journey credit score influence the minimal spending requirement?

When many individuals get the Chase Sapphire Reserve they’re making an attempt to succeed in the minimal spending requirement in an effort to earn the welcome bonus. How does the $300 you get reimbursed for journey play into that?

Effectively, the overall quantity you spend (minus the annual payment) counts towards the minimal spending requirement. So even should you get reimbursed $300 via the journey credit score, that $300 in spending would nonetheless rely towards the minimal spending requirement.

Do you earn triple factors for reimbursed transactions?

One of many nice issues concerning the Chase Sapphire Reserve is that it affords triple factors on eating and journey. So should you spent $300 on journey, you’d ordinarily earn 900 Final Rewards factors for that. Nonetheless, sadly you’re not going to be incomes triple factors for the quantity that’s reimbursed.

What occurs should you refund a transaction that’s reimbursed?

In case you refund a purchase order that was reimbursed, then the assertion credit score ought to equally be reversed, and the quantity ought to robotically be utilized towards a future journey transaction. Nonetheless, some report that the assertion credit score doesn’t get reversed, so this looks like a case of “your mileage might range.”

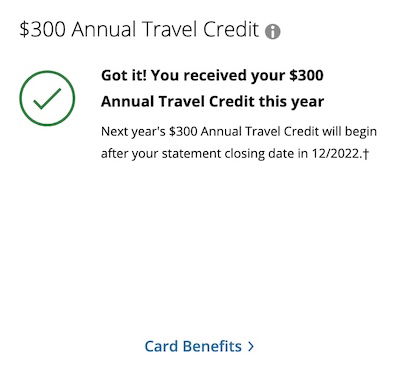

How will you observe how a lot of the $300 credit score you’ve used?

Once you go to the Final Rewards homepage and log into your account, click on on the “Your Dashboard” part, on the prime proper of the web page. There it’s best to see a bit that reveals how a lot of your spending towards the credit score you’ve accomplished, and it’ll additionally present when your anniversary 12 months resets, which might be once you get your subsequent credit score.

Do most individuals use the complete $300 credit score?

There is no such thing as a printed information on this, although I’d should assume {that a} overwhelming majority of individuals with the Chase Sapphire Reserve are totally using the journey credit score. That’s why I really feel snug suggesting that for many customers, it lowers the actual annual “out of pocket” on the cardboard by effectively over half.

Let me take it a step additional — should you don’t use the complete $300 journey credit score then this card merely isn’t for you. There are higher playing cards on the market for somebody who doesn’t spend at the very least $300 per 12 months on taxis, Ubers, subways, trains, lodges, airways, and so on.

Why doesn’t Chase simply decrease the annual payment to $250 as an alternative?

It is a logical sufficient query. If most individuals are so simply utilizing this credit score, then why not simply decrease the annual payment to $250, which might most likely make the cardboard much more widespread? There are two causes for this:

- Chase desires extra pockets share — Chase desires you to make use of your card as a lot as doable, and card issuers know that in the event that they’re reimbursing you for sure purchases, you’re extra more likely to truly use your card and have it on the entrance of your pockets

- Chase doesn’t wish to cannibalize its portfolio — Chase additionally has the Chase Sapphire Preferred® Card (review), which has a $95 annual payment and is also extremely rewarding; Chase doesn’t wish to fully cannibalize that card, so by going after two totally different customers when it comes to annual charges, Chase is in a position to try this

How does this examine to the Amex Platinum credit score?

Each The Platinum Card® from American Express (review) and The Business Platinum Card® from American Express (review) provide a wide range of credit as effectively. One of many credit they each provide is an annual $200 airline fee credit. There are some things that make this credit score not pretty much as good, although:

- The credit score is for $200, somewhat than $300

- The credit score solely applies to airline charges, somewhat than all journey purchases (and airline charges has a really particular definition)

- Registration is required, and you need to designate an airline for which you wish to use the credit score

Whereas the $200 airline payment credit score is simply a small a part of the Amex Platinum suite of benefits, that side of the cardboard is on no account aggressive, in my view.

Backside line

Many individuals are deterred by the Chase Sapphire Reserve’s $550 annual payment. Nonetheless, as I’ve typically mentioned, what makes this card so particular is that it’s a $550 annual payment card for individuals who don’t normally pay such excessive annual charges.

That’s as a result of in actuality, this card needs to be “costing” most individuals $250 per 12 months, after factoring within the $300 of worth they’ll get out of the journey credit score. This credit score isn’t a gimmick such as you would possibly discover on another playing cards, the place you need to register, can solely be reimbursed for very particular transactions, and so on.

As an alternative with this profit all journey coded purchases, as much as $300 per cardmember 12 months, will probably be reimbursed. When you have this card then it’s best to get full worth out of this superior profit.

“Paying” simply $250 per 12 months for triple factors on eating and journey, a Precedence Cross membership, the flexibility to redeem factors for 1.5 cents every, and rather more, is a discount. That’s what makes the Chase Sapphire Reserve so nice.

For extra on the best Ultimate Rewards credit cards, see this post.

[ad_2]

Source link

Recent Comments