[ad_1]

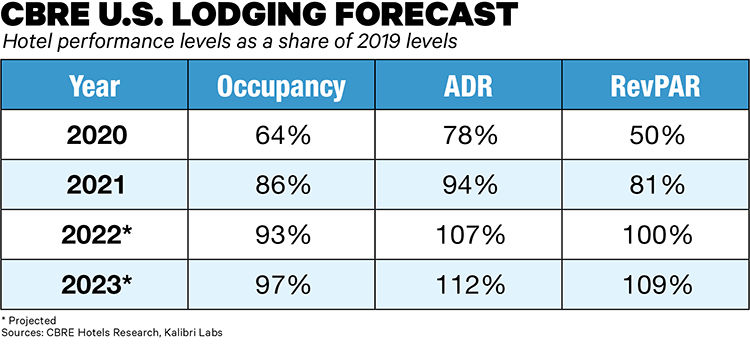

Because of what it known as inflationary price will increase, a sunny financial outlook and a slowing tempo of latest lodge development, CBRE Inns Analysis but once more has upgraded its 2022 U.S. lodging forecast and now initiatives 2022 income per obtainable room to achieve 2019 ranges, whereas common each day price already has.

First-quarter U.S. RevPAR reached $72.20, in response to CBRE, up 61 p.c 12 months over 12 months, whereas occupancy elevated 16 p.c and ADR elevated 39 p.c. ADR was 5 p.c of 2019 ranges, suggesting that neither Covid-19 nor rising gasoline and different costs have dented demand.

“Thus far, there was no signal that the greater than 50 p.c enhance in gasoline costs and the inventory market’s hovering close to bear-market territory are dampening lodge demand,” CBRE head of lodge analysis and information analytics mentioned Rachael Rothman mentioned in a press release. “Nonetheless, up to now, a steep decline within the S&P 500 and excessive gasoline costs have typically prompted RevPAR progress to say no, which raises the specter of a pullback in RevPAR later this 12 months. Regardless of this risk, our outlook stays that the market will proceed to get better.”

[Report continues below chart.]

CBRE most lately issued a full U.S. lodging forecast in March.

CBRE famous that whereas inflation has boosted charges, it additionally has pressured lodge funds concerning wages and meals and beverage prices, and rising development prices are inhibiting new lodge development. The corporate forecast provide in the course of the subsequent 5 years to extend at a 1.2 p.c compound annual progress price, “under the trade’s 1.8 p.c long-term historic common.”

[ad_2]

Source link

Recent Comments